Key Takeaways

- Seeking financial help, whether from personal connections or professionals, requires clear communication and understanding of your specific needs.

- Practical steps like budgeting, prioritizing savings, and differentiating needs from wants can greatly improve financial management.

- Tools such as the 50/30/20 budgeting rule, financial apps, and educational resources can simplify money management and empower informed decision-making.

- Building financial independence involves creating a sustainable plan, managing money effectively, and maintaining an emergency fund for unforeseen expenses.

- Offering financial help can go beyond monetary aid, including sharing advice, resources, or teaching budgeting methods to drive lasting improvements.

Managing money can feel overwhelming, especially when unexpected expenses pop up or savings seem out of reach. I’ve been there, wondering how to stretch every dollar and make smarter financial decisions. The good news? You’re not alone, and there are practical steps to take control of your finances.

Whether you’re trying to save more, pay off debt, or simply make ends meet, small changes can lead to big results. It’s all about understanding your priorities and creating a plan that works for your unique situation. Let’s explore how you can improve your financial well-being and feel more confident about your money.

Understanding The Phrase “Can You Help Me Money Wise”

This phrase combines a request for assistance with a specific focus on financial matters. It highlights the need for clarity and directness in asking for financial support or guidance.

What Does It Mean?

“Can you help me money wise” typically involves asking for financial help, advice, or support. The phrase suggests that the person is seeking practical assistance related to monetary issues. This could range from requesting funds for essential expenses to asking for tips on budgeting or improving financial habits.

Common Contexts Of Usage

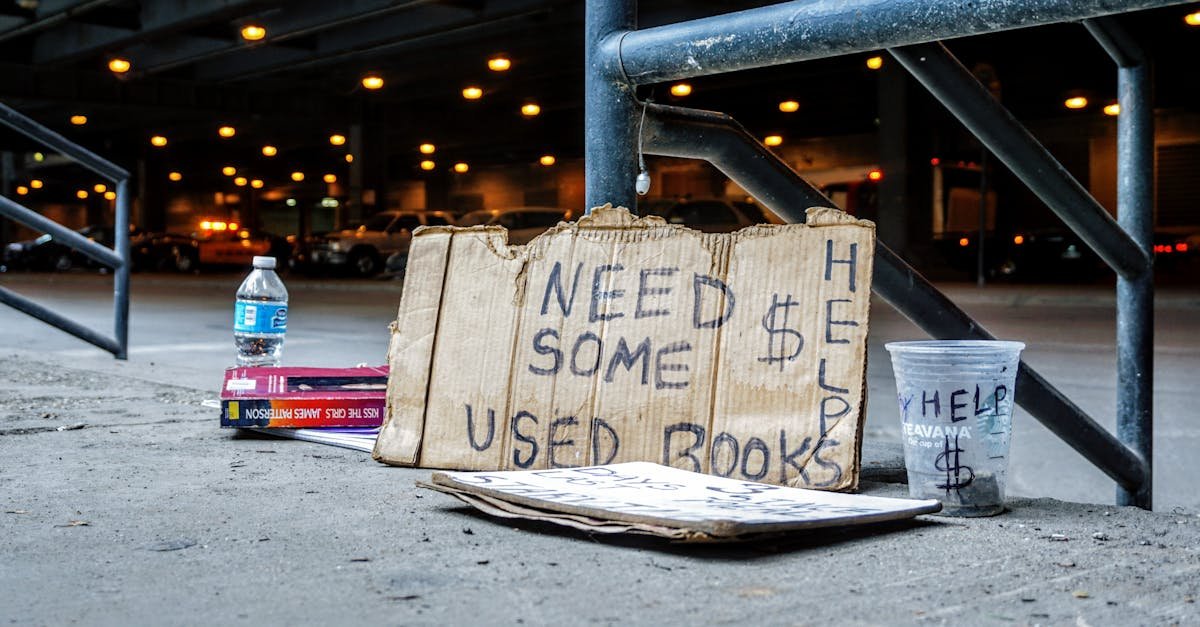

- Personal Requests: Individuals may use this phrase to request financial support from friends or family. For instance, asking for help with rent or covering an unexpected bill.

- Professional Guidance: People might use it when seeking financial advice from professionals, such as financial planners or advisors, to better manage their income or investments.

- Emergency Situations: It often appears during financial emergencies, such as medical bills or loss of income, where immediate assistance is necessary.

- Educational Scenarios: Students or learners might inquire using this phrase when seeking guidance on managing student loans or creating budgets while studying.

Each use of the phrase adapts to the relationship and context, whether casual or professional.

Practical Ways To Offer Financial Help

Supporting someone financially extends beyond giving money. Offering guidance, providing direct assistance, and sharing useful tools can make a lasting impact.

Offering Financial Advice

I recommend explaining financial concepts in simple terms. Start with helping them understand their income versus expenses. For instance, guide them in creating a basic cash flow sheet to track spending. Emphasize the importance of differentiating needs from wants and prioritizing savings for emergencies. Suggest reviewing reputable financial blogs or tools like Mint or Personal Capital for insights.

Providing Monetary Assistance

For direct help, decide on the amount you can offer without impacting your own financial stability. Use clear terms if it’s a loan, specifying repayment timelines to avoid misunderstandings. Alternatively, consider covering specific needs, like utility bills or groceries. For larger assistance, you could contribute to their emergency fund or offer to match their savings contributions up to a certain amount.

Sharing Budgeting Tips And Resources

I find sharing tangible tools and strategies helpful. Suggest they adopt the 50/30/20 rule, where 50% of income covers needs, 30% is for wants, and 20% goes to savings or debt repayment. Recommend budgeting templates or apps like YNAB (You Need A Budget). Share free online financial education courses or local community resources for further learning.

When And How To Ask For Financial Help

Understanding the right time and approach for seeking financial help is crucial. Proper preparation ensures that your request is clear and effective.

Assessing Your Situation

I first analyze my financial needs and resources before reaching out for help. This includes listing all expenses, income sources, and any outstanding debt. Identifying whether the issue is temporary (e.g., unexpected medical bills) or long-term (e.g., consistent budget shortfalls) provides clarity on what kind of assistance is required. For example, emergency expenses might need immediate aid, while consistent shortages could indicate the need for debt management advice.

I also establish the specific amount or type of support I require, whether it’s a loan, financial advice, or access to resources. Precise details, like “$500 to cover rent shortfall” or “guidance on reducing monthly expenses,” make requests more actionable.

Choosing The Right Person Or Institution

I select someone reliable or an institution aligned with my needs. For personal assistance, I approach family or friends with clear terms in mind, understanding their financial capacity. If seeking professional help, I consider financial advisors, nonprofit organizations, or community programs that specialize in specific areas such as budgeting or credit counseling.

For immediate monetary needs, I may explore options like employer advances or local charities. When reaching out, I ensure transparency about my situation and articulate how the assistance can address the identified problem. For instance, I might explain to a charity that their help could prevent utility disconnection or request a mentor to guide me through creating a realistic budget.

The Importance Of Financial Independence

Achieving financial independence creates stability and reduces reliance on external support. It allows individuals to set long-term goals and increases their ability to navigate unexpected financial challenges.

Building A Sustainable Financial Plan

A sustainable financial plan provides a roadmap for achieving independence. I prioritize analyzing my income, expenses, and savings to establish a comprehensive budget. Tools like spreadsheets or budgeting apps can simplify this process. Including an emergency fund equal to 3-6 months of living expenses prepares me for unforeseen events. Setting realistic goals—such as clearing debt, increasing savings, or investing—helps guide my progress. Regularly reviewing and adjusting the plan ensures it remains effective as my financial situation evolves.

Learning To Manage Money Effectively

Managing money effectively strengthens financial independence. I start by tracking all income and expenses to identify spending patterns and areas where I overspend. Differentiating between needs (e.g., housing and food) and wants (e.g., dining out or new gadgets) supports smarter financial decisions. I allocate funds using methods like the 50/30/20 rule, reserving 50% for needs, 30% for wants, and 20% for savings or debt repayment. To avoid overspending, I rely on cash or debit cards instead of credit whenever possible. Educating myself on personal finance topics, such as investing or interest rates, empowers me to make informed decisions about wealth building.

Conclusion

Taking control of your finances might feel overwhelming at first, but it’s absolutely possible with the right mindset and tools. Whether you’re offering help or seeking it, clear communication and thoughtful planning make a world of difference.

Small, consistent steps toward better money management can lead to lasting financial stability and independence. Remember, it’s not just about numbers—it’s about creating a plan that works for your unique situation and empowers you to make confident decisions.

Frequently Asked Questions

What are the first steps to take control of my finances?

Start by assessing your financial situation. List your income, expenses, and debts to understand your cash flow. Create a budget based on your priorities, track spending, and identify areas to cut unnecessary costs. Begin setting aside savings, even if in small amounts, to build financial security.

How can I save money when my income barely covers my needs?

Focus on differentiating between needs and wants. Look for small expenses to reduce and prioritize essential payments. Utilize budgeting methods, like the 50/30/20 rule, to allocate funds effectively. Avoid impulse purchases and consider free budgeting apps for better financial tracking.

What does “Can you help me money wise” mean?

This phrase is often used to request financial assistance or guidance. It can refer to asking for monetary support, financial advice, or understanding concepts like budgeting, debt management, or savings strategies. The meaning depends on the context of the conversation.

How can I offer financial help without giving money?

You can provide guidance, share budgeting tips, or help create a financial plan. Recommend useful tools like budgeting apps, explain the 50/30/20 rule, or teach how to track income and expenses. Assistance with tasks like reviewing bills or finding financial resources can also make a big impact.

When should I ask for financial help?

Ask for help when you’ve clearly defined your financial needs and explored other options. Assess your situation, determine the amount or type of support required, and be transparent about your circumstances. Choose the right person or institution and explain how the assistance will address your challenges.

How can I become financially independent?

Financial independence starts with a solid plan. Analyze your income, expenses, and savings to create a sustainable budget. Build an emergency fund, set realistic financial goals, and track your progress. Educate yourself about personal finance topics to make informed decisions and reduce reliance on external support.

What is the 50/30/20 rule?

The 50/30/20 rule is a simple budgeting method. Allocate 50% of your income to needs (essentials like rent and groceries), 30% to wants (non-essential spending), and 20% to savings and debt repayment. This framework helps prioritize spending and build financial stability.

How can I manage unexpected expenses?

Start by building an emergency fund to cover unforeseen costs. For immediate needs, adjust your budget to free up funds by reducing discretionary spending. Consider side gigs or selling unused items to generate extra income if necessary. Having a backup plan reduces stress during emergencies.

What should I include in a financial plan?

A good financial plan includes clear income and expense tracking, a workable budget, savings goals, debt repayment strategies, and an emergency fund. Setting priorities based on short-term and long-term goals ensures your plan is tailored to your unique financial situation.

How can I educate myself about personal finance?

There are many free or low-cost resources available. Start with personal finance books, podcasts, or blogs. Use educational platforms, financial literacy courses, or YouTube tutorials. Many budgeting apps and banks also offer tools and tips to boost your financial knowledge.